Do you dream of running your own online business and making money while you sleep? Well, dropshipping might just be the perfect option for you! But hey, before you dive into this exciting world, let’s talk about the tax implications of running a dropshipping business. Trust me, understanding the tax side of things is crucial to keep your business running smoothly!

Now, when it comes to taxes, things can get a little tricky. But don’t worry, I’m here to break it down for you in the simplest way possible. Running a dropshipping business means you don’t need to worry about storing or shipping the products yourself. It’s all handled by your suppliers. Cool, right? But here’s the deal – the tax implications can vary based on where you and your suppliers are located.

So, join me as we embark on this tax adventure together, exploring the ins and outs of running a dropshipping business and the tax implications you need to know. Trust me, understanding taxes doesn’t have to be boring! Let’s get started and ensure you’re on the right track for success!

What are the Tax Implications of Running a Dropshipping Business?

Dropshipping has become an increasingly popular business model in recent years, allowing entrepreneurs to sell products without the need for inventory or upfront capital. While dropshipping offers many advantages, such as low startup costs and flexibility, it’s essential to understand the tax implications associated with running this type of business. In this article, we will explore the various tax considerations that dropshippers need to be aware of, including sales tax, income tax, and international tax implications.

The Basics of Sales Tax for Dropshipping Businesses

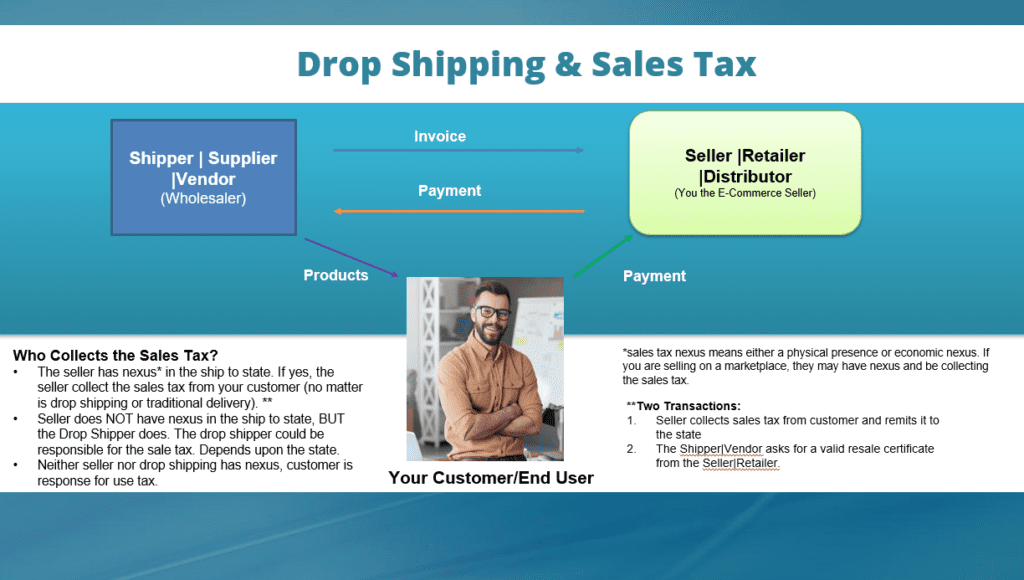

Running a dropshipping business means that you are acting as a middleman between the customer and the supplier. In most cases, you don’t physically handle the products or have them stored in a warehouse. Instead, when a customer places an order on your website, the order is forwarded to the supplier who then ships the products directly to the customer. This arrangement raises questions about sales tax responsibilities.

In the United States, sales tax obligations vary from state to state. As a dropshipper, you may be required to collect sales tax on orders shipped to certain states where your business has “nexus,” which refers to a physical presence or economic ties. Nexus can be established if you have a physical location, employees, or in some cases, if you generate a certain amount of sales in a particular state. It’s crucial to consult with a tax professional or advisor to determine your sales tax obligations and ensure compliance.

Income Tax Considerations for Dropshipping Business Owners

Income tax is another significant aspect to consider when running a dropshipping business. As a dropshipper, your income is derived from the profits you make on each sale, which will be subject to income tax. Dropshipping income is typically classified as self-employment income if you are running your business as a sole proprietorship or as part of a partnership.

It’s crucial to keep accurate records of your income and expenses related to your dropshipping business. This includes tracking your revenue, cost of goods sold, advertising expenses, website hosting fees, and any other business-related expenses. These records will be essential when it comes time to file your income tax returns and can help you take advantage of deductions and credits that can reduce your tax liability.

International Tax Implications for Dropshipping Businesses

Dropshipping businesses are not limited to operating solely within one country. Many entrepreneurs source products internationally and cater to customers around the world. While expanding your dropshipping business globally can be lucrative, it also introduces additional taxation considerations.

When shipping products internationally, you may encounter import taxes, duties, or customs fees imposed by the destination country. These costs can vary significantly depending on the country and the type of products you are shipping. It’s important to research and understand the customs regulations and tax obligations of each country you plan to do business with to avoid any surprises or unexpected expenses.

Additionally, if you have suppliers located in other countries, you may need to consider the possibility of withholding taxes. Some countries require businesses to withhold a portion of payments made to foreign suppliers and remit that amount to the respective tax authorities. It’s crucial to stay informed on international tax laws and consult with professionals who specialize in international taxation to ensure compliance and avoid any potential penalties or legal issues.

Ensuring Tax Compliance: Tips for Dropshippers

Now that you are aware of the various tax implications involved in running a dropshipping business, it’s important to take the necessary steps to ensure compliance with tax laws. Here are some essential tips to help you navigate the tax landscape effectively:

1. Consult with a tax professional: Seek advice from a qualified tax professional who specializes in small businesses or e-commerce to ensure you fully understand your tax obligations and can maximize deductions.

2. Keep meticulous records: Maintain proper documentation of all your sales, expenses, and financial transactions. Use accounting software or hire a bookkeeper to help you stay organized and track your business finances accurately.

3. Research sales tax obligations: Understand the sales tax laws in the jurisdictions where you have nexus and determine whether you need to collect and remit sales tax. Consider using sales tax automation software to streamline the process.

4. Separate personal and business finances: Open a separate bank account and credit card for your business to keep your personal and business finances separate. This will make it easier to track and report your business income and expenses.

5. Stay informed and adapt: Tax laws and regulations are subject to change, so it’s essential to stay updated on any updates or revisions. Join industry forums, attend webinars, or subscribe to newsletters to stay informed on tax-related matters.

Remember, while taxes may seem overwhelming, complying with tax laws is a fundamental responsibility for any business owner. By staying informed, seeking professional advice, and maintaining accurate records, you can ensure that your dropshipping business operates smoothly and mitigates any potential tax-related issues.

Key Takeaways: What are the tax implications of running a dropshipping business?

- Understand your tax obligations as a dropshipper, as you may be liable for income tax, sales tax, or both.

- Keep accurate records of your business income, expenses, and transactions to ensure proper reporting.

- Consider consulting with a tax professional to navigate complex tax laws and maximize deductions.

- Research and comply with state and local tax regulations to avoid penalties or legal issues.

- Be aware of any international tax implications if you partner with overseas suppliers or sell globally.

Frequently Asked Questions

Running a dropshipping business can be a lucrative venture, but it’s important to understand the tax implications. Here are some frequently asked questions related to the tax considerations of running a dropshipping business.

1. How are taxes calculated for dropshipping businesses?

When it comes to taxes, dropshipping businesses are typically treated as regular retail businesses. This means that you’ll need to report and pay taxes on your profits. The specific tax rate and calculation method will depend on your jurisdiction and the type of business structure you have, such as sole proprietorship or LLC.

It’s important to keep accurate records of your sales, expenses, and inventory to determine your taxable income. Consulting with a tax professional can be beneficial in understanding the specific tax obligations for your dropshipping business.

2. Are there any sales tax considerations for dropshipping businesses?

Yes, sales tax is an important consideration for dropshipping businesses. In the United States, for example, if your business has a nexus (a significant presence) in a state, you’ll generally be required to collect sales tax on sales made to customers in that state.

However, sales tax laws can be complex, with different rules and thresholds in each state. Some states may require you to register for a sales tax permit, while others may have certain exemptions or thresholds for small businesses. Researching and understanding the sales tax laws in your jurisdiction is crucial to ensure compliance.

3. Are there any international tax implications for dropshipping businesses?

Yes, there can be international tax implications for dropshipping businesses, especially if you sell products to customers outside your home country. When you sell goods internationally, you may need to comply with import/export regulations, customs duties, and taxes imposed by the destination country.

Each country has its own rules and regulations regarding customs duties and taxes, and it’s essential to familiarize yourself with these requirements before expanding your dropshipping business internationally. Seeking guidance from an international trade expert or tax professional can help you navigate these complexities.

4. What deductions can dropshipping businesses claim?

Dropshipping businesses may be eligible for various deductions to reduce their taxable income. Some common deductions include expenses related to product sourcing, website hosting, packaging materials, marketing, professional fees (such as legal or accounting services), and shipping costs. Additionally, if you operate your dropshipping business from a dedicated workspace at home, you may be able to claim a portion of your home office expenses.

It’s important to keep detailed records of your business expenses and consult with a tax professional to ensure you’re maximizing your eligible deductions while staying within the boundaries of tax laws and regulations.

5. How can I stay compliant with tax laws as a dropshipping business?

To stay compliant with tax laws as a dropshipping business, it’s crucial to maintain accurate records of your sales, expenses, and inventory. Implementing a robust accounting system and keeping detailed financial records will help you accurately calculate and report your taxable income.

Consider consulting with a tax professional who specializes in small businesses and e-commerce to ensure you understand your tax obligations and to seek guidance on tax planning strategies. Additionally, staying updated on any changes to tax laws and regulations, especially those applicable to e-commerce businesses, is essential to remain compliant and avoid any penalties or legal issues.

Everything You Need To Know About Shopify Dropshipping Taxes (2022)

Summary

Running a dropshipping business can have important tax implications that you need to understand. One key aspect is sales tax – you may be responsible for collecting and remitting it depending on where your customers are located. Keep track of your expenses and make sure to deduct them when filing your taxes. Remember to report any income from your dropshipping business and pay the appropriate taxes. Seek professional advice if you’re unsure about any tax matters.